Introduction

As the vibrant city-state of Singapore continues to grow and evolve, so does the demand for innovative and sustainable transportation solutions. Car-sharing startups have emerged as a popular choice among urban dwellers seeking a flexible and eco-friendly alternative to traditional car ownership.

These startups offer a convenient platform for users to access vehicles for short periods, reducing congestion, and contributing to a greener environment. However, with this revolutionary business model comes a unique set of risks and challenges that car-sharing startups in Singapore must navigate.

One crucial aspect that can protect them from potential financial pitfalls and legal liabilities is having comprehensive commercial auto insurance.

In this blog, we will delve into the importance of commercial auto insurance for car-sharing startups in Singapore, explore the risks they face, and highlight how proper insurance coverage can ensure their success and sustainability.

Understanding Car-Sharing Startups in Singapore

Car-sharing startups have rapidly gained popularity in Singapore due to their convenience and environmental benefits. The concept is simple – users can access vehicles on-demand through a mobile application or online platform, paying only for the time they use.

This shared economy approach appeals to both residents and tourists, offering a cost-effective means of transportation without the burden of car ownership. Car-sharing startups typically maintain a fleet of vehicles stationed strategically throughout the city, making it easy for users to find and access a vehicle whenever needed.

Risks Faced by Car-Sharing Startups

While the car-sharing model presents numerous advantages, it also exposes startups to specific risks and challenges that are inherent in the industry. Some of the key risks faced by car-sharing startups in Singapore include:

Accidents and Collisions:

With a growing number of drivers accessing shared vehicles, the probability of accidents and collisions increases. Even with strict driver screening processes, accidents can happen, leading to property damage, injuries, and potential liability claims.

Vehicle Damage and Theft:

The frequent use of shared vehicles exposes them to more wear and tear than privately owned cars. Additionally, the risk of theft or vandalism increases when vehicles are parked in various locations around the city.

Liability Claims:

Car-sharing startups can be held liable for accidents caused by their users. Injuries to passengers, pedestrians, or other drivers could lead to substantial legal claims against the startup, potentially resulting in significant financial losses.

Regulatory Compliance:

The car-sharing industry is subject to various regulations and licensing requirements in Singapore. Startups must adhere to these rules to ensure compliance and avoid facing penalties or disruptions in their operations.

The Importance of Commercial Auto Insurance

For car-sharing startups in Singapore, commercial auto insurance is not merely an option but a critical investment. It provides comprehensive coverage that protects the company from financial losses and legal liabilities arising from the risks mentioned above. Here are some compelling reasons highlighting the importance of commercial auto insurance for car-sharing startups:

Asset Protection:

Commercial auto insurance provides coverage for damages to vehicles caused by accidents, natural disasters, theft, or vandalism. With a robust insurance policy in place, startups can ensure that their assets are protected and swiftly repaired or replaced without incurring significant financial burdens.

Liability Coverage:

In the unfortunate event of an accident, car-sharing startups may face legal claims from affected parties. Commercial auto insurance offers liability coverage, which is crucial for settling medical expenses, property damage claims, and legal fees. This protection can save the startup from bankruptcy or financial ruin in the face of substantial claims.

Compliance with Regulations:

In Singapore, car-sharing startups are legally required to have proper insurance coverage for their vehicles. Complying with these regulations is not only a legal necessity but also an ethical responsibility to users and the community.

Peace of Mind:

Having comprehensive commercial auto insurance provides car-sharing startups with peace of mind. They can operate confidently, knowing that they are protected against unforeseen events and potential financial hardships.

Attracting Investors and Partnerships:

Investors and potential partners often consider the level of risk management and preparedness of a startup before making decisions. Having proper insurance coverage signals responsibility and foresight, making the startup more attractive to potential investors and collaborators.

Types of Commercial Auto Insurance Coverage

When selecting commercial auto insurance coverage for their car-sharing business, startups in Singapore should consider the following essential options:

Comprehensive Insurance:

This coverage protects against damages to vehicles caused by accidents, fire, theft, vandalism, or natural disasters.

Third-Party Liability Insurance:

This coverage provides financial protection in case the startup is held liable for injuries or property damage caused by their vehicles.

Personal Accident Insurance:

Personal accident coverage offers financial support for injuries or fatalities to drivers and passengers involved in accidents.

Loss of Use Coverage:

In the event of a covered claim, loss of use coverage reimburses the car-sharing startup for the income lost while the vehicle is being repaired or replaced.

Uninsured or Underinsured Motorist Coverage:

This coverage protects the startup and its users in the event of an accident caused by a driver with insufficient or no insurance coverage.

Conclusion

In conclusion, car-sharing startups in Singapore must recognize the importance of commercial auto insurance as an integral part of their business strategy. By acknowledging the risks they face and investing in comprehensive insurance coverage, startups can protect their assets, manage potential liabilities, and ensure regulatory compliance.

Commercial auto insurance not only provides financial protection but also offers peace of mind to founders, investors, and users alike. As the car-sharing industry continues to evolve and thrive in Singapore, insurance will remain an indispensable component for startups to flourish, innovate, and contribute to a sustainable future in urban transportation.

NOTE: Please be aware that the information presented about commercial auto insurance for car-sharing businesses in Singapore may be subject to changes and updates over time. To ensure that you have the most accurate and up-to-date details regarding eligibility requirements and regulations, it is essential to stay informed by referring to official websites and relevant government sources.

Regularly checking for updates will help you stay current with any modifications or new guidelines related to commercial auto insurance for car-sharing businesses in Singapore. By staying vigilant and informed, you can make well-informed decisions and ensure compliance with the latest requirements for your car sharing venture in Singapore.

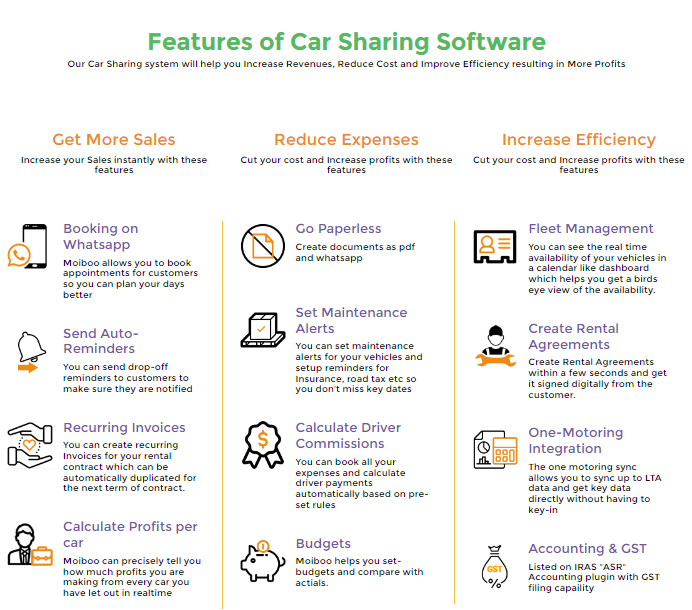

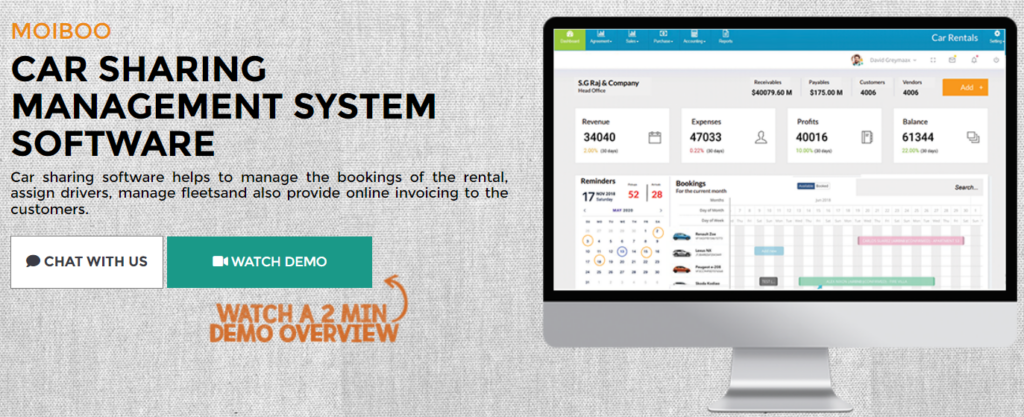

Unlock the Full Potential of Your Car Sharing Business with Moiboo Car Sharing Software

Revolutionize your car-sharing business with the cutting-edge Moiboo Car Sharing Software, a comprehensive solution that is eligible for the Productivity Solutions Grant (PSG). Designed to cater to your unique business needs, this advanced software seamlessly integrates a wide range of features to boost productivity and streamline your operations.

Say goodbye to tedious manual tasks and welcome enhanced efficiency with Moiboo Car Sharing Software – an intuitive solution that automates and simplifies complex processes. From managing bookings and scheduling appointments to effortlessly tracking inventory and generating invoices, this user-friendly software takes care of it all.

By automating these essential processes, you can save valuable time, reduce errors, and focus on revenue-generating activities to drive your business forward. Moiboo Car Sharing Software optimizes your operations, ensuring maximum productivity and unlocking your business’s true growth potential.

Experience the transformative power of Moiboo Car Sharing Software by requesting a free demo today. Our team of experts will guide you through its functionalities, providing a clear understanding of how it streamlines workflows and fuels revenue growth.

What’s more, Moiboo Car Sharing Software has already received pre-approval for the PSG Grant, simplifying the application process for your business. Rest assured that the software meets all the grant’s requirements, giving you peace of mind and allowing you to fully capitalize on its benefits.

To schedule your free demo or make further inquiries, please reach out to us at +65 9895 1817. Our dedicated team is committed to helping you optimize your business operations, maximize revenue, and seize the incredible opportunities offered by the PSG Grant. Elevate your car-sharing business to new heights of success today.