Introduction

Starting a car-sharing business can be an exciting venture, as it provides a convenient and cost-effective transportation option for users. However, along with the opportunities, there are also potential risks and liabilities involved in managing a fleet of shared vehicles. One of the most crucial aspects of safeguarding your car-sharing business is choosing the right insurance policy.

In this comprehensive guide, we will walk you through the essential steps and considerations to help you make an informed decision when it comes to insurance coverage for your car-sharing venture.

Understanding the Insurance Needs of Your Car-Sharing Business

Before diving into the realm of insurance policies, it is essential to assess your specific business requirements. Different car-sharing models and operational structures may demand varying types and levels of insurance coverage.

Conduct a thorough analysis of your fleet size, vehicle types, geographic locations, and target audience. This assessment will help you identify the primary risks your business faces and determine the right level of coverage to protect both your company and your customers.

Identifying the Types of Insurance Coverage

When selecting an insurance policy for your car-sharing business, it’s crucial to consider the various types of coverage available. Here are some key insurance options to evaluate:

a. Commercial Auto Liability Insurance: This is fundamental insurance coverage that protects your car-sharing business against third-party bodily injury and property damage claims resulting from accidents involving your shared vehicles.

b. Comprehensive and Collision Coverage: These types of coverage protect your fleet against damages caused by theft, vandalism, natural disasters, and collisions, regardless of fault.

c. Uninsured/Underinsured Motorist Coverage safeguards your business and customers in the event of an accident with a driver who lacks adequate insurance or has no insurance at all.

d. General Liability Insurance: In addition to auto liability coverage, you may need general liability insurance to protect your business against non-vehicle-related claims, such as slip and fall incidents at your car-sharing locations.

e. Commercial Umbrella Insurance: This provides additional liability protection that goes beyond the limits of your primary insurance policies, offering an extra layer of security for high-cost claims.

Evaluating Insurance Providers

Selecting the correct insurance provider holds equal importance to choosing suitable coverage. When evaluating insurance companies, consider the following factors:

a. Experience and Expertise: Look for insurers with experience in providing insurance solutions to the car-sharing industry. They will have a better understanding of your specific needs and potential risks.

b. Financial Stability: Check the financial strength and ratings of the insurance companies under consideration to ensure they can meet their obligations when claims arise.

c. Customer Service and Claims Handling: Read reviews and seek feedback from other car-sharing business owners regarding their experiences with different insurers’ customer service and claims handling processes.

d. Customizable Policies: Find an insurer that offers flexibility in tailoring policies to your unique business requirements. Avoid a one-size-fits-all approach as it may leave you underinsured.

Understanding Policy Exclusions and Limitations

Thoroughly examine the terms and conditions of the insurance policies under consideration. Pay close attention to policy exclusions and limitations that could affect your coverage. Some common exclusions may include intentional acts, racing, and use of the vehicle outside designated operating areas. Understanding these limitations will help you make informed decisions and prevent any surprises during the claims process.

Compliance with Local and State Regulations

Each region and state may have specific insurance requirements for car-sharing businesses. Ensure that the insurance policy you choose meets or exceeds the minimum coverage mandates in your operating locations. Non-compliance with local regulations could lead to fines, penalties, or even the suspension of your car-sharing operations.

Seek Professional Advice

Navigating the complexities of insurance policies can be challenging, especially if you are new to the car-sharing industry. Consider consulting with an insurance broker or an industry expert who specializes in car-sharing businesses. They can help you understand your insurance needs, compare different policies, and negotiate better rates on your behalf.

Ongoing Review and Policy Updates

Your responsibilities continue even after selecting an insurance policy. As your car-sharing business evolves and grows, your insurance needs may change. Regularly review your policies and coverage limits to ensure they align with your current operations. Be proactive in updating your insurance as necessary to avoid any gaps in coverage.

Conclusion

Selecting the right insurance policy is a critical step in protecting your car-sharing business from potential liabilities and risks. By understanding your business’s specific insurance needs, evaluating different coverage options, and partnering with a reliable insurance provider, you can ensure that your venture is well-protected.

Remember to review your policies regularly and stay informed about any changes in local regulations or industry practices. With the right insurance coverage in place, you can confidently focus on growing your car-sharing business and providing excellent service to your customers.

NOTE: Please be advised that the information provided about commercial auto insurance for car-sharing businesses in Singapore may be subject to changes and updates in the future. To ensure that you have the most accurate and up-to-date details regarding eligibility requirements and regulations, it is vital to stay informed by referring to official websites and relevant government sources.

Frequently checking for updates will help you remain current with any modifications or new guidelines related to commercial auto insurance for car-sharing businesses in Singapore.

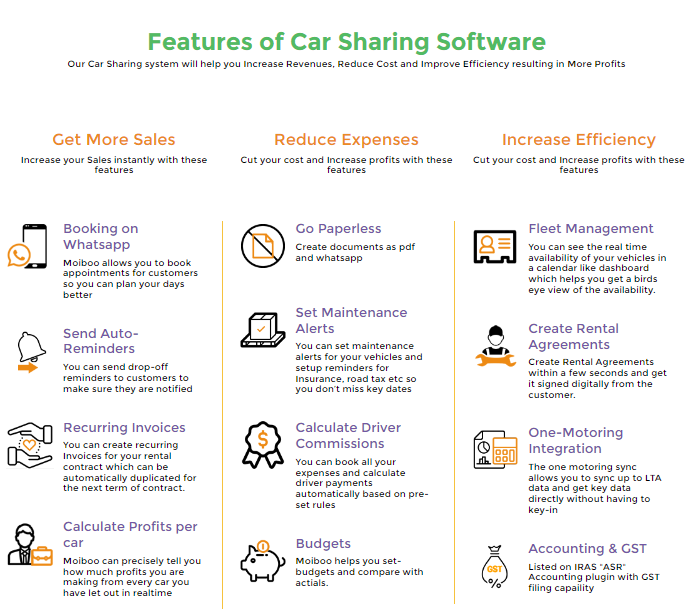

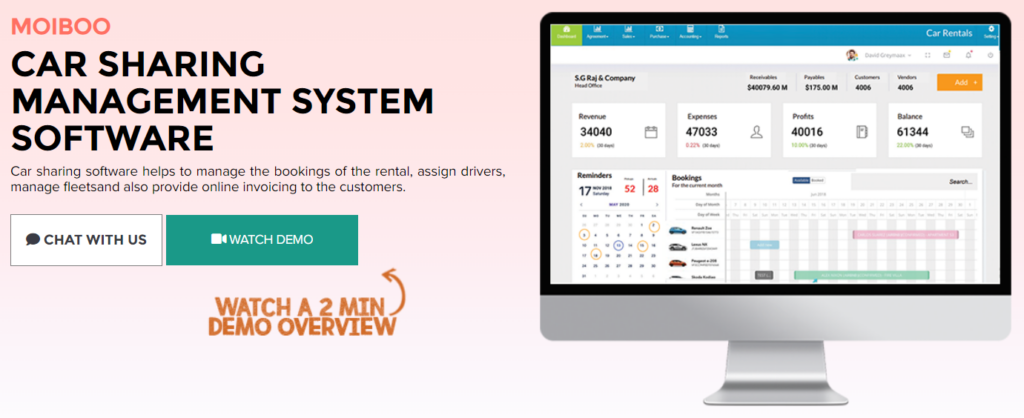

Unlock the true potential of your car-sharing business with Moiboo Car Sharing Software – a cutting-edge solution eligible for the Productivity Solutions Grant (PSG). Tailored to meet your specific business needs, this advanced software seamlessly integrates a wide range of features to enhance productivity and streamline operations.

Leave behind tedious manual tasks and embrace enhanced efficiency with Moiboo Car Sharing Software. This intuitive solution automates and simplifies complex processes, from managing bookings and scheduling appointments to effortlessly tracking inventory and generating invoices. By automating these essential tasks, you can save valuable time, reduce errors, and focus on revenue-generating activities, propelling your business toward success.

Moiboo Car Sharing Software optimizes your operations, ensuring maximum productivity and unlocking your business’s growth potential. Experience its transformative power by requesting a free demo today. Our expert team will guide you through its functionalities, demonstrating how it streamlines workflows and boosts revenue.

What’s more, Moiboo Car Sharing Software has already received pre-approval for the PSG Grant, making the application process hassle-free. With its compliance with the grant’s requirements, you can confidently leverage its benefits.

To schedule your free demo or make inquiries, reach out to us at +65 9895 1817. Our dedicated team is committed to helping you optimize your business operations, maximize revenue, and seize the incredible opportunities offered by the PSG Grant. Elevate your car-sharing business to new heights of success today.